Managing cash flow is crucial for the success of any business, and one of the key challenges faced by many companies is waiting for their clients to pay their outstanding invoices. The delay in receiving payments can hinder the smooth operation and growth of a business. This is where invoice factoring can help businesses.

Invoice factoring provides businesses with a financial solution to swiftly convert their outstanding invoices into readily available cash. It provides an effective way to bridge the cash flow gap and maintain a steady working capital. In this article, we will explore what invoice factoring is, how it works, provide examples, and highlight the sectors where invoice factoring is commonly used.

What is Invoice Factoring?

Invoice factoring, also known as accounts receivable factoring or debtor financing, involves selling unpaid invoices to a third-party company known as a factor. The factor then advances a percentage of the invoice value, usually around 80% to 90%, to the business upfront.

The remaining amount, minus the factor’s fee, is paid to the business once the client settles the invoice. Essentially, invoice factoring enables businesses to access the funds they are owed sooner rather than later, eliminating the wait for payment.

Process Involve in Invoice Factoring

Here are the processes involved in business invoice factoring:

1. Selling Invoices

The business sells its outstanding invoices to a factoring company, known as the factor. The factor analyzes the creditworthiness of the business’s clients to assess the risk involved.

2. Advancing Funds

Once the factor approves the invoices, it advances a certain percentage of the total invoice value to the business, usually within 24 to 48 hours. This immediate injection of cash provides businesses with the working capital they need to cover expenses or invest in growth opportunities.

3. Collecting Payments

The factor takes responsibility for collecting payments from the business’s clients. The factor manages the accounts receivable and follows up with the clients for timely payment.

4. Final Payment

Once the client settles the invoice, the factor pays the remaining amount to the business, minus its fee or discount. The fee is typically calculated based on factors such as the creditworthiness of the clients, the volume of invoices, and the duration until payment.

Best Examples of Accounts Receivable Factoring

Now, let’s take a look at a couple of examples to better understand how invoice factoring works:

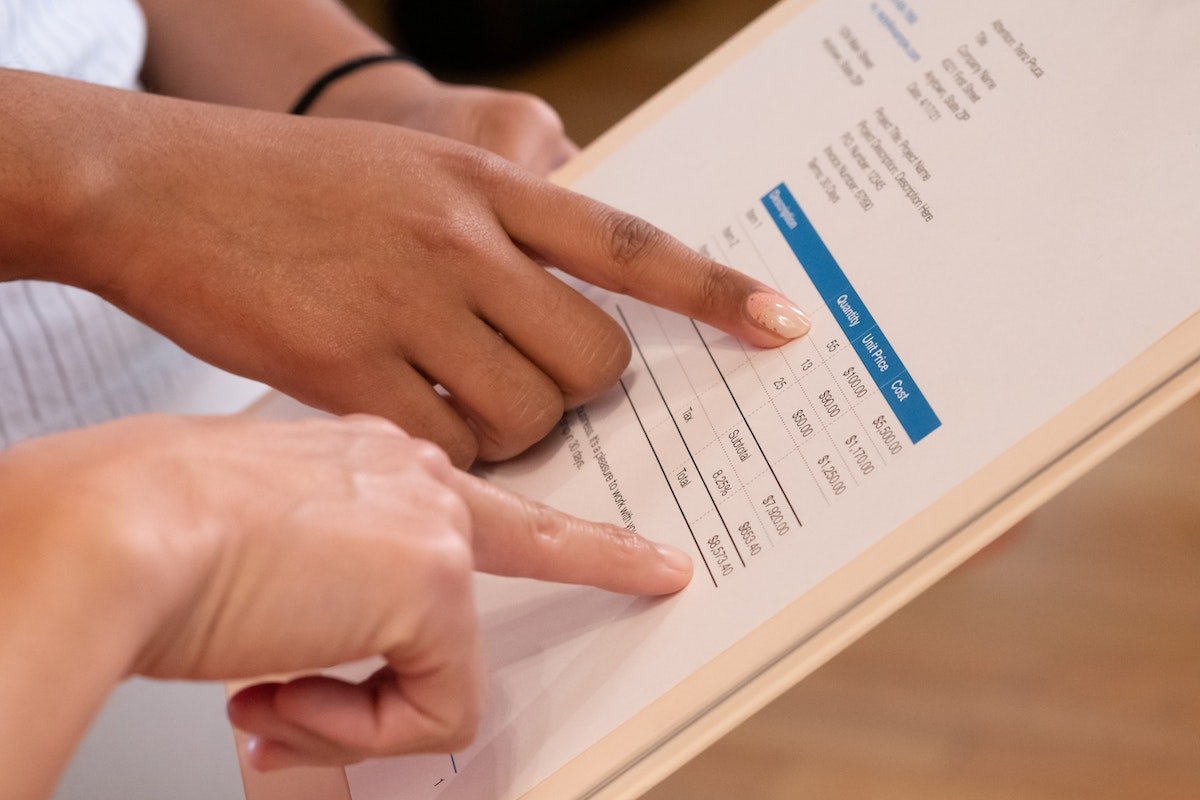

Example 1

ABC Manufacturing Company has several outstanding invoices totaling $100,000 from its clients. They decide to factor these invoices with a factor that offers an 85% advance rate.

The factor immediately provides ABC Manufacturing with $85,000 (85% of $100,000) in cash. Once the clients settle the invoices, the factor deducts its fee, say 3% ($3,000), and pays the remaining $12,000 to ABC Manufacturing.

Example 2

XYZ Services is a small business facing cash flow issues due to clients taking a longer time to pay their invoices. They decide to factor their invoices with a factor that offers an 80% advance rate.

XYZ Services has outstanding invoices totaling $50,000, and the factor advances them $40,000 (80% of $50,000). The factor collects the payments directly from the clients and pays XYZ Services the remaining $10,000 after deducting its fee.

Sectors Where Invoice Factoring Are Commonly Used

Invoice factoring is commonly used in various sectors and industries. Some of the sectors where invoice factoring is frequently employed include:

1. Manufacturing

Manufacturers often face the challenge of long payment cycles, where they have to wait for extended periods to receive payment from their customers. Invoice factoring provides manufacturers with the necessary working capital to cover operational expenses, purchase raw materials, and invest in growth opportunities.

2. Transportation and Logistics

The transportation and logistics industry relies heavily on steady cash flow to cover fuel costs, driver salaries, vehicle maintenance, and other operational expenses. Invoice factoring allows trucking companies, freight brokers, and logistics providers to access immediate funds based on their outstanding invoices, ensuring smooth operations and growth.

3. Staffing and Recruitment

Staffing agencies and recruitment firms frequently face delays in receiving payments from their clients. Invoice factoring enables these businesses to bridge the gap between invoicing and payment, ensuring they have the necessary funds to pay their employees, cover administrative costs, and expand their talent acquisition efforts.

4. Healthcare and Medical Services

Medical practices, clinics, and healthcare providers often have to wait for insurance companies or government agencies to process and reimburse their claims. Invoice factoring offers a solution to maintain cash flow while waiting for payments, enabling healthcare providers to meet their financial obligations, purchase medical supplies, and invest in technology and equipment.

5. Construction

The construction industry often deals with long project cycles, which can result in delayed payments. Invoice factoring provides construction companies with immediate cash flow, allowing them to cover payroll, purchase materials, and take on new projects without being hindered by payment delays.

6. Information Technology

IT consulting firms, software development companies, and technology service providers frequently use invoice factoring to manage their cash flow. It helps them overcome the challenges of delayed client payments and ensures they have the necessary funds to invest in research and development, hire skilled professionals, and expand their business operations.

7. Wholesale and Distribution

Wholesale businesses, distributors, and suppliers often have large volumes of outstanding invoices. Invoice factoring allows them to access funds based on these invoices, enabling them to manage inventory, fulfill orders, and maintain relationships with their suppliers.

It’s important to note that invoice factoring can be beneficial for businesses across various sectors that rely on accounts receivable. By converting their unpaid invoices into immediate cash, these businesses can maintain a healthy cash flow, seize growth opportunities, and ensure their operations continue smoothly.

Read Also:

- What is Invoice Discounting?

- Invoicing Discount Vs Factoring: What is The Actual Difference?

- Best Companies for Accounts Receivable Factoring

Author Bio: Adil is a founder and manager partner at oBookkeeping, a virtual accounting and bookkeeping company. He regularly writes on accounting, bookkeeping, finance and various business topics.